It’s a very unfortunate situation when a person happens to have an accident which results in a total loss of the vehicle and an even worse when said person doesn’t know the process of how insurance companies determine how they will be willing to settle with the victim. When you’ve been in a car accident, the emotional and physical damages can feel overwhelming. Between trips to visit the doctor, intensive physical therapy, loss of time spent with friends and family, and lack of ability to enjoy recreational activities, sometimes all you want is to put it all behind you and move on.

Why the Insurance Company Will Agree to Settle

There is certainly no guarantee that an insurance company will offer to settle your claim just because you were in an accident. In fact, they might actually attempt to deny the claim altogether. For this reason, it’s essential to understand what the insurance company is looking for in order to settle and resolve your car accident injury claim.

- Strong eyewitness testimony – when there are many people at the scene of the accident who can attest that the other driver was at fault, the insurance company might be more inclined to settle.

- There is an admission of guilt – if the insured driver admits that they were at fault, their insurance company will likely look to settle.

- The insurance company believes you’ll take a lesser settlement offer than you are probably entitled to.

- Physical evidence – a traffic camera caught the other driver running a red light and colliding with your car. In this case, their insurance company would most likely try to settle the claim.

Your Behavior After an Accident

When you are in an accident, there are certain behaviors to avoid and certain steps you can take to help support your claim and chances of settlement.

- Don’t admit fault for the accident. Avoid saying “sorry,” as others can consider this an admission of guilt.

- Make sure you seek medical attention and retain a record of the examination.

- Call the police and file an official report detailing the accident.

- Collect eyewitness testimony, photos, and other evidence that shows what happened in the accident.

- Contact an experienced personal injury attorney to figure out next steps and how best to proceed.

How to Maximize Your Settlement with the Insurance Company

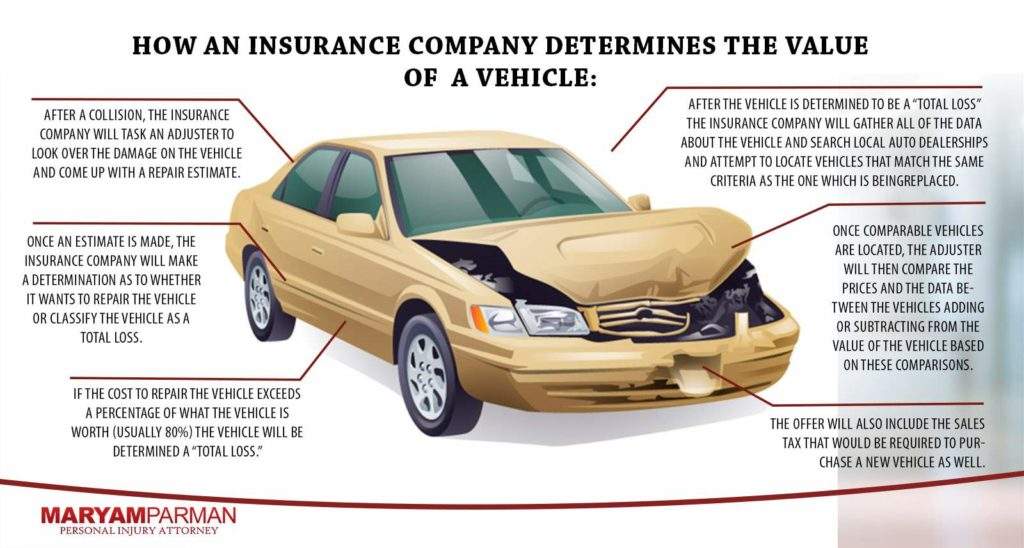

Insurance companies often utilize outside vendors to provide a detailed report in which comparable vehicles in the area will be listed and their respective asking price. Most of the time these reports are accurate, but sometimes they aren’t. It’s very important as an insurance consumer to educate yourself when you have to deal with an insurance company in order to settle the total loss of your vehicle. It’s only after you managed to arm yourself with knowledge and do your due diligence that you’ll be in a much stronger and safer position when the company decides to present you with their settlement offer, which may or may not suit your current situation.

We are often asked how an insurance company will determine the value of a vehicle that has been deemed a total loss after an unfortunate accident. A less common but recurring question is “Do they use the Kelley Blue Book or Edmunds guide?” and the answer is no. This is because Californian law prohibits an insurance company from using search guides in order to determine the value of a vehicle as these guides are national in scope, and the value of your vehicle may be higher or lower than their figures based on the market available in your area. Insurance companies often have to determine the market value or the actual cash value in your specific geographic location. They usually accomplished this by searching local advertisements in order to find comparable vehicles for sale. These can often take the form of printed advertisement in a newspaper or online shopping sites. An insurance adjuster may also attempt to talk to a dealership in order to get a quote for comparable vehicles.

Usually, an insurance company will attempt to come up with up to a dozen comparable vehicles and will list their average price to arrive to what they may estimate the actual cash value of your vehicle. After that, they will typically attempt to present you with the total loss settlement offer, hoping that you accept it and sign the release. This is the moment where your knowledge of previous research may come handy. First and foremost, when you first suspect that your vehicle may be a total loss, you should start doing your own research. Look at websites that have used cars for sale in your area and try to find as close a match to your car as you can (year, maker, model, mileage, and condition). One thing to note is that you’ll be trying to find comparable vehicles with the highest asking price. Try to find between 5 and 10 comparable that are on the higher end of the price spectrum. Add up all the prices and then divide by the number of comparable vehicles in your sample in order to get the average.

When an insurance company presents you with their settlement offer, you should have a good idea of whether their offer is a fair deal or whether it may be too low for you to recover your losses. The settlement process isn’t about haggling back and forth like you would with a used car salesman, though. They want to settle the claim as much as you do so that they can get the file off their desk and move on to the next case. However, they need documentation to put in their file to show how they arrived at the final settlement figure. You can help them by letting them know that you have done your research and feel that their offer is way too low. A good practice is to ask to see if they report or research in order to see how they arrived at the figure they are now offering you.—they are obligated to provide you with that information should you ask them about it;—then provide them with your research and request that they compare the vehicles that you found with your research to their least and average them out. This will usually increase the overall figure.

In some cases, the offer they give you’ll be fair and sometimes it may also be higher than you researched. In any case, by doing your due diligence and arming yourself with the necessary information, you’ll be in a better position to determine if the insurance company’s offer is accurate. If their offer is low, you now have the ammunition to bolster your position and maximize your total loss settlement.

If You Were in an Accident, Call a Us Today

As you might imagine, working with the insurance company after you have been injured can feel like a full-time job without much reward. For this reason, it’s best to hire a skilled personal injury car accident lawyer to help you through this process. We have the experience and understanding required to navigate the insurance claims process. We will advocate for your rights after a car accident, allowing you to focus on recovering from your injuries while we tackle conversations with the insurance companies. You can call us or contact us online today to schedule a free initial consultation.